While ARR is our “north star” KPI, it is an imperfect measure of progress, success, or company value. ARR does not tell the full story because it only shows quantity and not the quality of the revenue. As an operator, I rely on what I call “hero KPIs” to guide the financial models, budgets, projections, and strategic decisions. Hero KPIs save funding rounds when the ARR isn’t so hot. So what are those hero KPIs (at least for me)?

Before we begin, an important note: measure customer cohorts individually! There are core behaviors between cohorts that differ, and not only will these differences skew the blended metrics but also lead to suboptimal decisions. While I find company firmographics a helpful base to build upon, I have learned to pay particular attention to how the customer groups buy, adopt the product, and downgrade/upgrade the plans.

Customer cohorts aren’t static either. A significant change in features or pricing will warrant reconsideration of customer segmentation. Just as you should look into re-cohorting with noticeable shifts in how customers spend, adopt, use, or expand.

Pull the outliers out of the KPIs and footnote when necessary. Yes, sometimes our KPIs look so much better with outliers we haven’t segregated out but then why lie to ourselves.

Hero KPIs:

Price consistency/median discount

While the median discount extended to customers within the cohort is a simple formula, the solution for maintaining and improving the KPI is a formidable feat. While (often) Heads of Sales may be significant influencers of the price consistency, they are not the sole ones. It is a fine team effort between sales, product, and finance. Heads of Product have the feature “dials” and package the right features addressing specific customer cohorts’ needs, making defending product value proposition easier. Heads of Sales instill the discipline and continuously adjust the compensation structure to focus the sales team on the right priorities. And lastly, Heads of Finance have the finance and legal “dials” that can provide the sales leverage. In the end, if cohort median discount extended is in low single-digit percentages – it is a strong team win.

Time to Complete Onboarding (TCO)

Not a KPI I see talked about much, yet we should treat it with high importance. How long does it take to the point when customers start using the product without assistance from the client experience team. TCO is the most sensitive period in the customer lifecycle because the lion’s share of churn in the 1st year is often due to slow or otherwise problematic onboarding. Large deviations in TCO within a cohort tell me we need to look at the documentation, onboarding process, and the team (if not self-serve). On the positive side, if TCO is going down gradually and is consistent across the cohort, that is worthy of a slide in the board or pitch deck. The sooner our customer is fully-onboarded, the sooner we can discover if we can add value for them and expand the account.

Net Revenue Retention (NetRR)

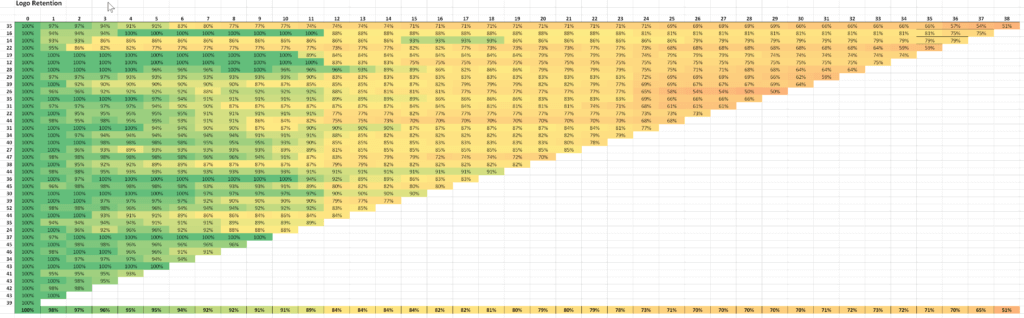

You may encounter this KPI with other names and abbreviations as NRR, NRRR, NetRRR, or Net Dollar Retention (NDR), yet it is calculated the same way: (starting MRR + upgrades – downgrades – churn)/starting MRR. NetRR by itself isn’t as powerful until we put it in the context of a month-to-month cohort analysis dashboard. Monthly NetRR cohort analysis holds the top spot in my KPI stack. Anomalies, variances, or consistent behavior – all early signals we can address.

- Is the sales team “leaving money on the table” during the initial sale? Do we over-rely on pilots and paid trials? Is our value proposition clear enough for the customer to commit to us?

- Are we doing a good job onboarding and then upselling? Are we reaching out at the right time to renew and upsell?

- Did those new features resonate with the customers and, most importantly, motivated them to upgrade?

- Is there a pattern of when we lose importance in our customers’ minds, and when is the right time to reach out?

This is just a sampling of questions NetRR analysis gives me.

Churn – Core Cohorts Only

While blended churn is a KPI often on top of our minds, I advocate for focusing only on the core cohorts. This focus requires we vocalize/admit serving non-core cohorts is a temporary cashflow-driven decision. While these non-core cohorts find value in our product, in the startup stage, the focus is essential. When non-core customer churns (or we gracefully churn them), it is beneficial for the company. Blending non-cores with cores is punishing the team for focus – counterproductive.

Are there other hero KPIs? Magic Number, Net Sales Efficiency, ARR/FTE, LTV/CAC are some of my favorites. Unfortunately, until we are closer to 4+ years of product/market fit, data is not good enough to obtain reliable numbers.

When it comes to tools to gather and deliver reporting for the mentioned KPIs, I would like to say Excel is no longer the dominant one. The most popular CRM platforms, like Salesforce and HubSpot, do provide base reporting tools. But I have found augmenting the reporting stack with SaaS analytics offerings, like Price Intelligently (my absolute favorite), Baremetrics, or ChartMogul, is a worthy investment.

This post is one of my “live ones” I update as I discover something new to share. If this is a topic that interests you, I would love to see you as a subscriber of my In Pursuit of Scalability newsletter.